Get the free kraform

Show details

Change Document Font Size Manual Typewriter Check Spelling Email Form Save Form TR-300 SUPERIOR COURT OF CALIFORNIA, COUNTY OF FOR COURT USE ONLY STREET ADDRESS: MAILING ADDRESS: CITY AND ZIP CODE:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kraform form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kraform form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kraform online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit kraform. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

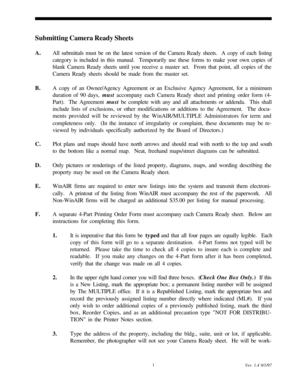

How to fill out kraform

How to fill out kraform?

01

Start by gathering all the necessary information and documents required for filling out the kraform. This may include your personal details, income details, and any other relevant information.

02

Carefully read and understand the instructions provided on the kraform. Familiarize yourself with the different sections and fields that need to be filled out.

03

Begin filling out the kraform systematically, starting with the basic details such as your name, address, and contact information. Ensure that all the information provided is accurate and up-to-date.

04

Move on to the next sections, which may require you to provide details about your income such as salary, investments, and other sources of income. Be thorough and provide all the necessary information as per the guidelines provided.

05

If applicable, fill out any specific sections or fields related to business or self-employment income. This may require providing details about business revenues, expenses, and profit/loss statements.

06

Double-check all the information you have entered to ensure accuracy and completeness. Take the time to review each section before moving on to the next one.

07

Once you have filled out all the required fields, make sure to sign and date the kraform as instructed. Failure to do so may render the form invalid.

Who needs kraform?

01

Individuals who earn income in Kenya, whether through employment, business, or other means, may need to fill out the kraform. It is typically required by the Kenya Revenue Authority (KRA) for income tax purposes.

02

Business owners, entrepreneurs, and self-employed individuals who operate in Kenya may also need to fill out the kraform to report their business income and comply with tax regulations.

03

In some cases, even non-residents who earn income in Kenya may be required to fill out the kraform. This includes individuals who generate income from rental properties, investments, or other sources within the country.

Note: It is always advisable to consult with a tax professional or contact the KRA directly for specific guidance on who needs to fill out the kraform based on individual circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

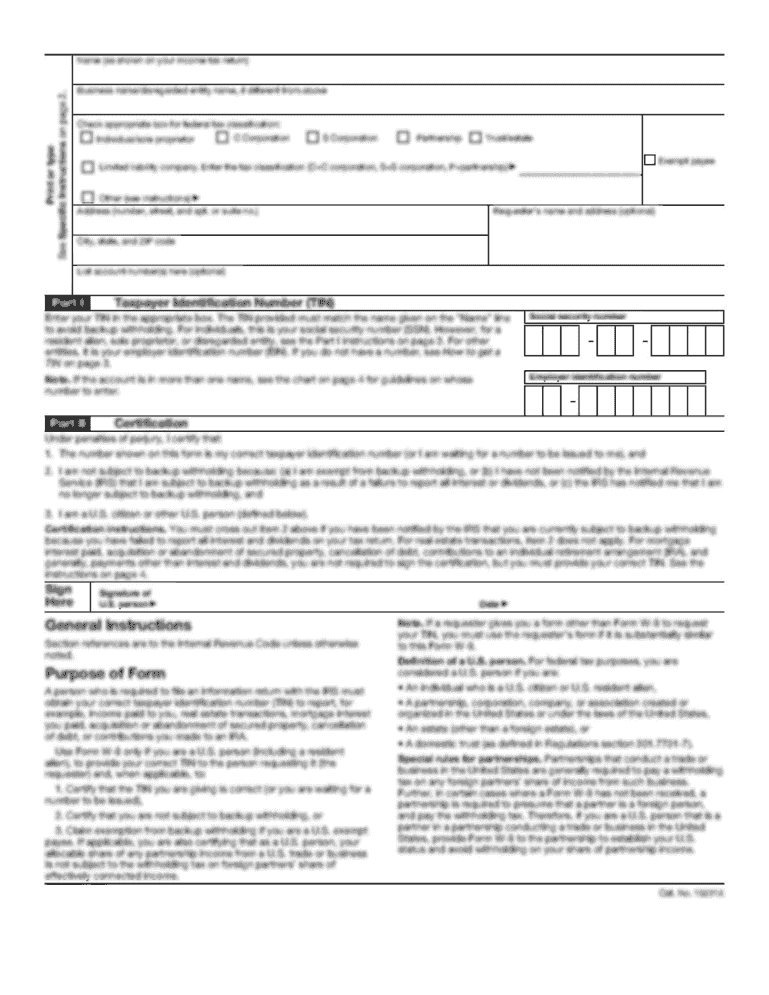

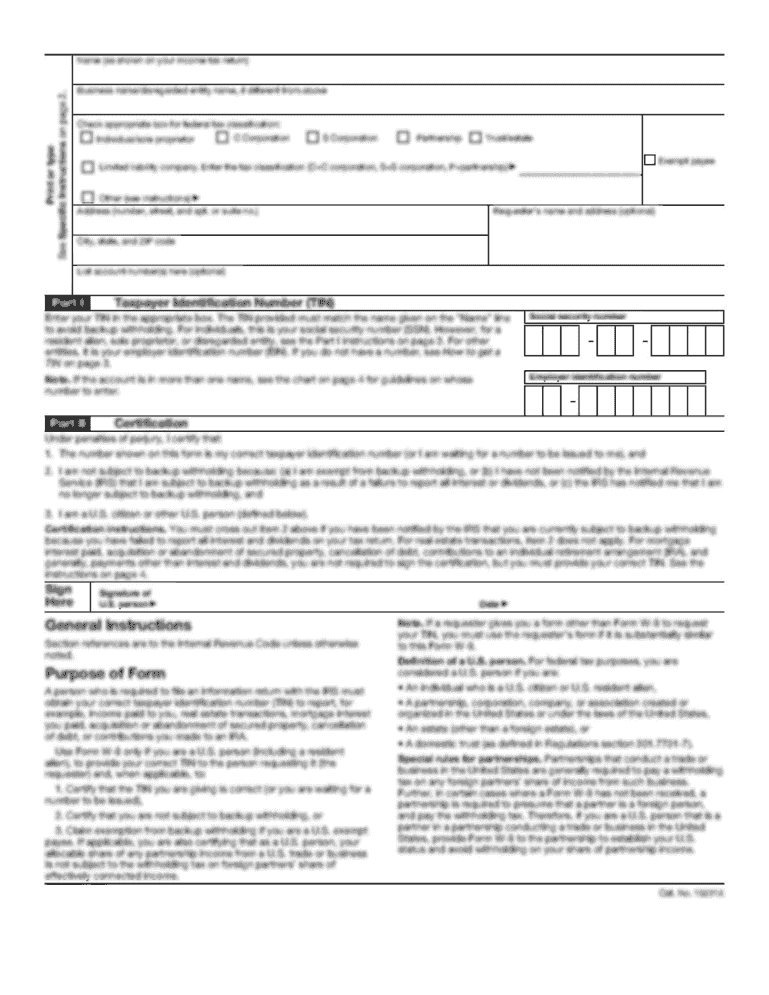

What is kraform?

Kraform stands for Kenyan Revenue Authority (KRA) form. It is a form used for tax filing and reporting in Kenya.

Who is required to file kraform?

Any individual or entity who earns income subject to taxation in Kenya is required to file kraform.

How to fill out kraform?

To fill out kraform, you need to provide accurate and complete information about your income, deductions, and other relevant details as required by the form. You can fill it out online or manually.

What is the purpose of kraform?

The purpose of kraform is to report and declare taxable income, deductions, and tax liabilities to the Kenyan Revenue Authority for the assessment and collection of taxes.

What information must be reported on kraform?

On kraform, you must report your income from various sources, deductions, expenses, and other relevant financial information required for tax assessment.

When is the deadline to file kraform in 2023?

The deadline to file kraform in 2023 has not been specified yet. It is recommended to refer to the official announcements and guidelines provided by the Kenyan Revenue Authority for the most accurate information.

What is the penalty for the late filing of kraform?

The penalty for the late filing of kraform in Kenya includes a fine imposed by the Kenyan Revenue Authority. The specific amount of the penalty depends on the duration of the delay and the assessed tax liability.

Where do I find kraform?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the kraform. Open it immediately and start altering it with sophisticated capabilities.

How do I complete kraform online?

pdfFiller has made filling out and eSigning kraform easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit kraform on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share kraform on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your kraform online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.